UI Benefit Payment Control (BPC) Audits, Overpayments, Fraud and Frequently Asked Questions - Unemployment Insurance

The Benefit Payment Control (BPC) unit promotes and maintains the integrity of the unemployment insurance (UI) program through prevention, detection, investigation, establishment, recovery and prosecution of UI overpayments made to claimants.

Unemployment Insurance Overpayment

An overpayment occurs when a claimant (an individual who submits a claim for UI benefits) receives a benefit payment to which the claimant is not entitled.

Overpayments can occur due to a penalty resulting from: an issue with the claimant’s separation from employment; changes in a claimant's availability for work; audit results; unreported or underreported wages; and appeal decisions reversing a claimant’s eligibility for UI benefits, among other reasons.

If you are overpaid, the Maryland Division of Unemployment Insurance will send you an Overpayment Determination, which will include the reason you are overpaid, the amount of overpaid benefits, repayment instructions, and appeal instructions.

Unless your overpayment is waived or overturned on appeal, you will be required to repay the overpaid benefits and any additional fines, penalties, and interest. Otherwise, legal action may be taken to collect the debt.

NOTE: You do not need to repay these amounts while any timely appeal or waiver request is pending.

A claimant may pay an overpayment balance in the BEACON UI system or by check or money order.

To pay by check or money order:

- Make payable to the DEPARTMENT OF LABOR; and,

-

Mail payments to P.O. Box 1931

Attention: Benefit Payment Control

Room 206

Baltimore, MD 21203-1931

- To ensure proper credits to your account, please put your Claimant ID on all payments and correspondence.

To pay in BEACON:

- log in to your portal in the BEACON UI system; and,

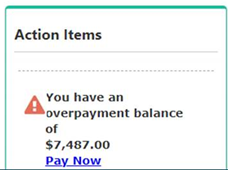

- select the “Pay Now” link under the Action Items section of your portal’s homepage. See the image below.

- In BEACON, you may pay by ACH electronic bank transfer.

Additional Information: