How to Apply for UI Benefits in BEACON - Unemployment Insurance

Applying for unemployment insurance (UI) benefits, also called filing an initial claim, is the first step in your UI process. You may file an initial claim in the online BEACON UI system, 24/7, or by calling a claims agent at 667-207-6520 (Monday to Friday, 8:00 a.m. to 4:00 p.m.).

The information below provides detailed instructions about filing an initial claim in BEACON. However, the information you provide when you file an initial claim is the same whether you file in BEACON or by phone.

Step 1 - Begin the Initial Claim Process

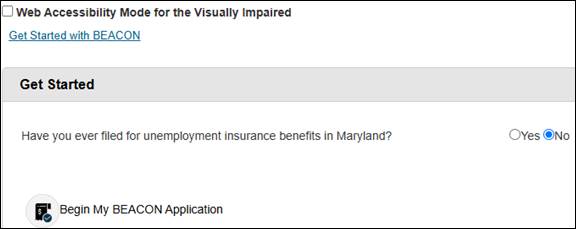

If you are filing for Maryland UI benefits online for the first time:

Visit beacon.labor.maryland.gov. Select the Get Started with BEACON link.

Answer No to the question about whether you previously filed for UI benefits in Maryland.

Select Begin My BEACON Application.

Enter personal details and create a username and password. Save your login credentials securely.

- Key Tip: Make sure your name matches your Social Security Card.

NOTE: If you previously filed for UI benefits in BEACON, log in, select the Apply for Benefits option from the left menu, and follow the prompts to file an initial claim.

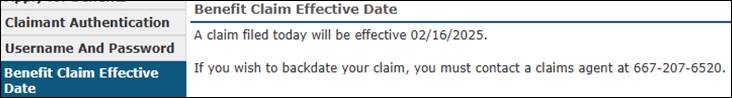

Step 2 - View Claim Effective Date, Provide Address, and Answer Initial Questions

- On the next screen, your benefit claim effective date will be displayed. Your benefit claim effective date determines when your benefits begin (the date is the Sunday before you file your initial UI claim).

- Enter your residential and mailing address. BEACON may suggest an address. Please use this address, if it is correct.

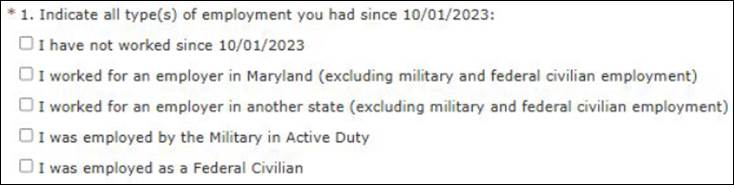

- On the next screen, provide details about your employment during the last 18 months.

- Select the options that apply to you. Indicate if you worked outside of Maryland, served in the military, worked as a federal employee, or worked as a federal contractor (an employee who worked for a private sector employer that contracts with the federal government).

NOTE: If you see a banner about out-of-state wages, read it carefully and respond accurately to avoid delays in processing your UI claim.

Step 3 - Provide General Information

- Enter your contact information and choose a communication preference (the way the Division will provide information to you).

- Email/text alerts are the fastest and most efficient methods.

- Provide personal details (race, ethnicity, veteran/disability status, education, citizenship, dependents, etc.).

- If you have dependent children under 16, list them now. You can not add dependents after filing an initial claim. However, you can add their Social Security numbers within 30 days of filing.

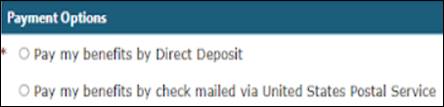

Step 4 - Select Payment Method and Tax Withholding

- Choose your benefit payment method (either direct deposit or paper check sent by U.S. mail).

NOTE: You must enroll in direct deposit payments online, as staff are not able to enter your personal financial information. If you opt for check payments, you must verify your mailing address in BEACON.

- Tax Withholding: Choose one of the following:

- Federal (10%) and Maryland (7%) tax withheld;

- Only federal (10%) tax withheld;

- Only Maryland (7%) tax withheld;

- No tax withheld.

Step 5 - Enter Work and Employment Details

- If you are a union member seeking work through a union hiring hall or business agent, provide information on your union (including union name and local number).

- Provide your customary occupation (the type of job you have the most experience in and have worked in for a significant period).

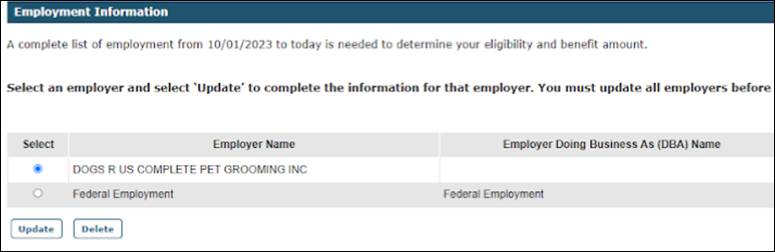

- Please enter your employment information. BEACON will automatically populate all in-state employment it has on record for you in the past 18 months.

- If an employer is missing, enter that employer’s information manually. Use your W-2s to find accurate employer information

Then, provide additional employment details for each employer, including:

- Your most-recent, physical work address (for each employer);

NOTE: Do not enter the employer’s payroll mailing address or head office location as your most-recent, work address if you did not physically work there.

- Employer contact information;

- Your first and last days of employment;

- Whether you worked full-time or part-time;

- Hourly pay rate;

- Reason for separation;

- Return-to-work date (if applicable).

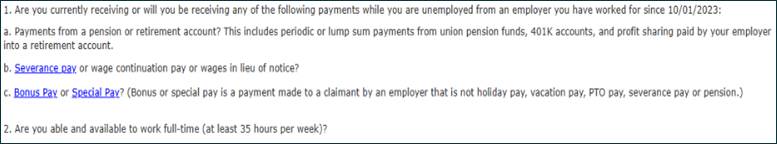

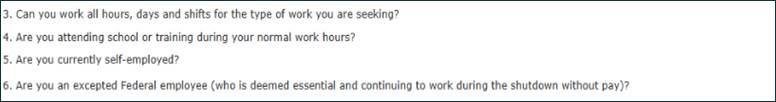

Step 6 - Answer Eligibility Questions

- Report any payments you received or know you will receive (vacation pay, holiday pay, special pay, severance pay, retirement/pension payments, or back pay/damages).

- Confirm your availability for work.

To be eligible, you must be able and available for work, meaning you are physically and mentally capable of performing your customary occupation and ready to accept work immediately. This means you must be available to work all required hours, days, and shifts that are typical for your job without restrictions.

For example, you may not be considered able and available due to:

- Lack of childcare or transportation;

- Attending school full-time;

- A medical condition that prevents you from working; etc.

Step 7 - Select 1099-G Delivery Method

IRS Form 1099-G reports the total amount of UI benefits you received in a tax year.

These benefits are considered taxable income and must be reported on your federal

tax return.

- Choose whether you will receive this form electronically or by mail.

The 1099-G is usually sent in January. For details, see the 1099-G FAQs.

Step 8 - Answer Security Questions

- Answer security questions to confirm your identity.

- If you fail to answer these questions correctly, you may need to submit additional documentation and/or speak directly with agency staff – which may cause delays in processing your UI claim.

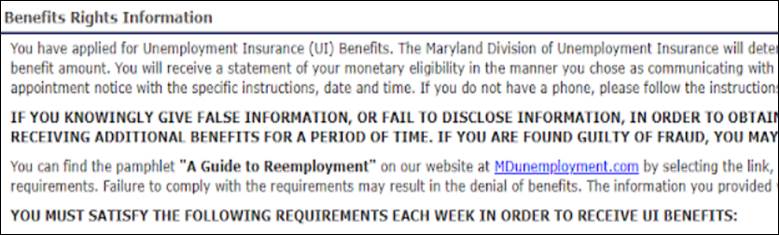

Step 9 - Read Benefit Rights Information and Submit Initial Claim

- Double-check all information before submitting your claim to avoid errors or delays.

- Read and acknowledge the Benefit Rights Information.

- Read this carefully, as this includes key guidelines on how/why you could be disqualified or ineligible for UI benefits.

- Save your Claimant ID and select Finish.

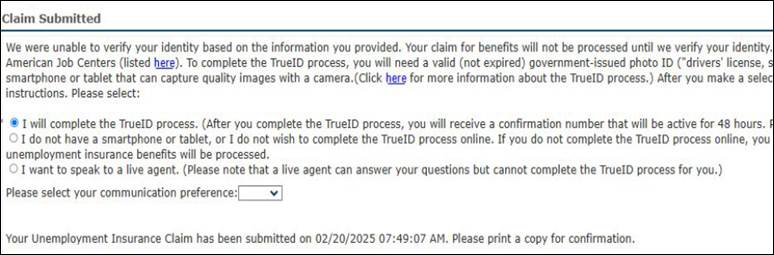

- If additional verification of your identity is required, you may be prompted to complete the TrueID Process. For more, see the TrueID Identity Verification Process FAQs.

After You File

After you file an initial claim, log in to BEACON regularly to:

- view correspondence (select the Correspondence option from the left menu in BEACON and then select the search button);

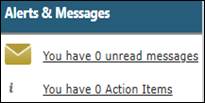

- complete any action items (navigate to the Alerts & Messages section on the left side of the screen. Then, select the Action Items link to view);

- see eligibility issues associated with your claim (select the Eligibility Issues option from the left menu); and,

- perform additional UI tasks (see BEACON Instructions for Completing Common Claimant UI Tasks).