Federal Employees: Frequently Asked Questions About Unemployment Insurance

Employees Impacted by the Federal Government Shutdown

Federal employees and federal contractors may be eligible for unemployment insurance benefits and other programs during a furlough. Learn more about eligibility and when to file.

Federal civilian employees who become unemployed due to no fault of their own can apply for Unemployment Compensation for Federal Employees (UCFE).

You may apply for UI benefits under the federal UCFE program in Maryland if:

- your last official duty station was in Maryland, or,

- you are a Maryland resident, and your last official duty station was outside of the United States; or,

- you are a Maryland resident, separated from federal employment, and then worked in non-federal employment in Maryland.

NOTE: Your duty station is listed on your SF-50.

If none of those three criteria apply to you, you should apply for UCFE in the U.S. state or district where your duty station is located or in your state or district of residence (if your duty station was outside of the U.S. or if you separated from federal employment and then worked in non-federal employment).

After you apply, you are required to complete a 935 affidavit and provide proof of your income and proof documenting your federal employment. If you do not, your UI benefits will be delayed, and if neither you nor your employer provide proof of your income, we will not be able to process your claim. See questions #13 and #14 for more.

If you are participating in the Deferred Resignation Program and are currently on administrative leave, you are not eligible for unemployment insurance benefits because you are still considered employed. Once your administrative leave ends, you may apply, and your eligibility will be determined based on your unique circumstances. Generally, individuals who voluntarily leave employment (without good cause or valid circumstances) are not eligible for unemployment insurance benefits. However, eligibility for individuals who participated in the Deferred Resignation Program will be evaluated on a case-by-case basis. Please provide any supporting documents related to your separation.

Employees who worked for a private sector employer that contracted with the federal government and who lost their job through no fault of their own are eligible to apply for regular unemployment insurance. See the Regular UI Overview flyer for information on how to apply for the regular Maryland UI program. If you are furloughed, you may still file an unemployment claim on the first day of being furloughed.

You may be eligible for unemployment insurance (UI) benefits, depending on whether you are a W-2 or 1099 employee. Generally, 1099 employees (freelancers/independent contractors/self-employed individuals) are not eligible for UI benefits.

- Please apply for UI benefits, and the Maryland Division of Unemployment Insurance (Division) will determine whether you are eligible. For details, see How to Apply for UI Benefits inMaryland Unemployment Insurance Portal (BEACON).

NOTE: If you disagree with the Division’s determination about your eligibility for UI benefits, you may file an appeal. For more, see How to File an Appeal.

For questions, call 667-207-6520 (Monday to Friday, 8:00 a.m. to 4:00 p.m.).

If you have been separated from employment through no fault of your own, you should file for benefits to determine if you are eligible.

You should still file a claim for unemployment insurance to assess your eligibility, indicating that you were terminated on your application. The agency will determine whether you qualify. To assist in determining your claim, you should provide all the information you have received on your separation and any documentation or information you may have regarding your performance.

You should file for unemployment insurance to determine your eligibility. We consider all wages earned in the past 18 months, so any previous employment may affect your eligibility.

If you began working at your federal job in Maryland after September 30, 2024, you must file in the other state. If you started a federal job in Maryland before September 30, 2024, then you can file in Maryland.

If you are discharged from employment due to no fault of your own, you may be eligible for unemployment insurance benefits. However, voluntarily quitting your job without “good cause” generally disqualifies you from receiving unemployment benefits except under certain limited circumstances. The Maryland Division of Unemployment Insurance will review your reason for separation, along with other eligibility requirements, and will determine if you are eligible. Applicants who are determined to be ineligible can file an appeal.

You can file on the first day you are unemployed. While on administrative leave, you are still considered employed. However, If you are separated at a later time from employment due to no fault of your own, you may be eligible for unemployment insurance benefits if you meet the requirements. The Maryland Division of Unemployment Insurance will review your reason for separation, along with other eligibility requirements, and will make a determination accordingly.

When you apply for unemployment insurance under the UCFE program, you will need your:

- SF-8, Notice to Federal Employee About Unemployment Insurance form; and,

- SF-50, Notification of Personnel Action form.

Federal employers provide these forms to their employees upon separation from employment. If you have not received these forms, contact your agency’s HR department. You will also need your W-2 and recent pay stubs. For more information, see the Information and Documents Needed for Claims Filing document.

In Maryland, applicants may apply for unemployment insurance under the UCFE program by calling a claims agent at 667-207-6520 (Monday to Friday, 8:00 a.m. to 4:00 p.m.) and selecting option #9. You can also apply online through the BEACON UI system. Online filing is available at any time, 24/7.

After you apply for unemployment insurance under UCFE, you are required to complete a 935 affidavit with proof of income and, proof documenting your prior federal employment, including your agency.

- The 935 affidavit (Claimant Affidavit of Federal Civilian Services, Wages and Reasons for Separation) includes information used to determine your eligibility for unemployment insurance benefits, such as your duty station, proof of your wages, reason for separation from employment, severance pay, and pension.

- If you do not provide this information, your UI benefits will be delayed, and if neither you nor your employer provide proof of your income, we will not be able to process your claim.

Note: You will receive an Action Item in the Maryland Unemployment Insurance Portal (BEACON) to complete the 935 affidavit. If your preferred communication method is email or text, you will also receive a notice that you have a new Action Item. If mail is your preferred method, a physical copy of the 935 affidavit will also be sent to you.

- The 935 affidavit will ask for the reason you separated from federal employment, wage information, severance pay, etc.

- W-2s, pay stubs, and the SF-50 are acceptable as proof of income.

- The SF-50 and SF-8 are acceptable as proof of agency. Please use the agency name included on your SF-50 on the 935 affidavit.

You can select your preferred communication method when you file an initial claim, and you can change it in the Maryland Unemployment Insurance Portal (BEACON) at any time by logging in, navigating to the Quick Actions section of the portal, selecting “Change Communication Preference,” and following the prompts.

You must download the ES-935 affidavit form, fill it out, then submit it by uploading the completed form to the Maryland Unemployment Insurance Portal (BEACON) or mailing in a hard copy. If you do not provide this information in a timely manner, your UI benefits will be delayed. If neither you nor your employer provide proof of your income, we will not be able to process your claim.

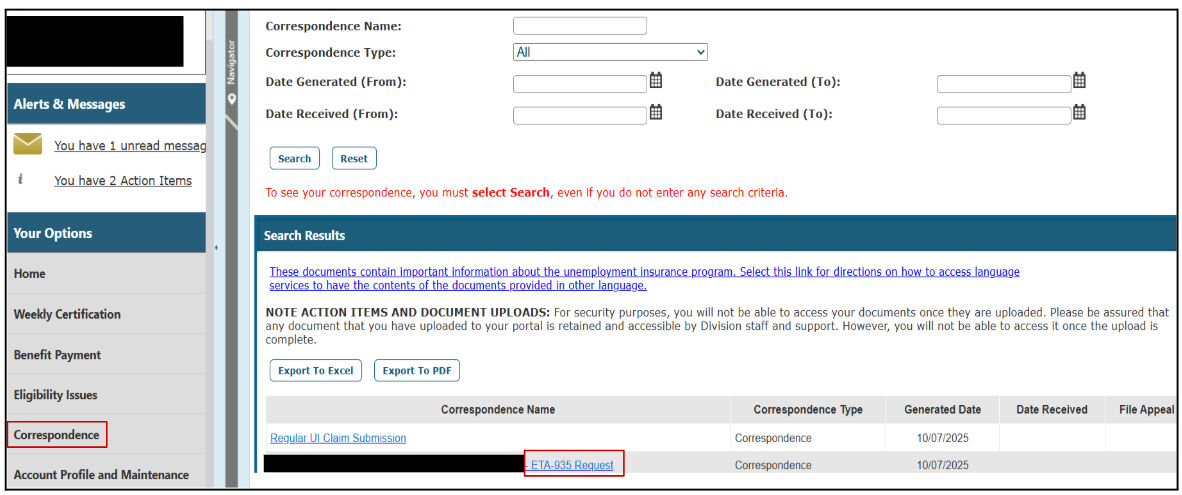

To access the form, log into the Maryland Unemployment Insurance Portal (BEACON) and select the Correspondence option from the left menu. Select the search button to view your correspondence.

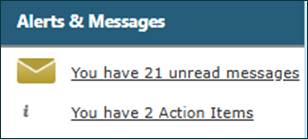

To upload the form, after you have logged in, navigate to the action items center of the homepage (under the Alerts and Messages section), and select the action items link.

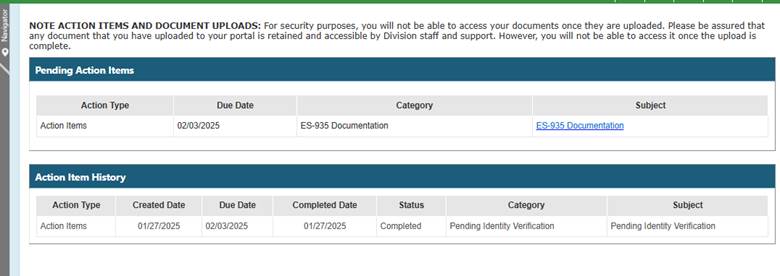

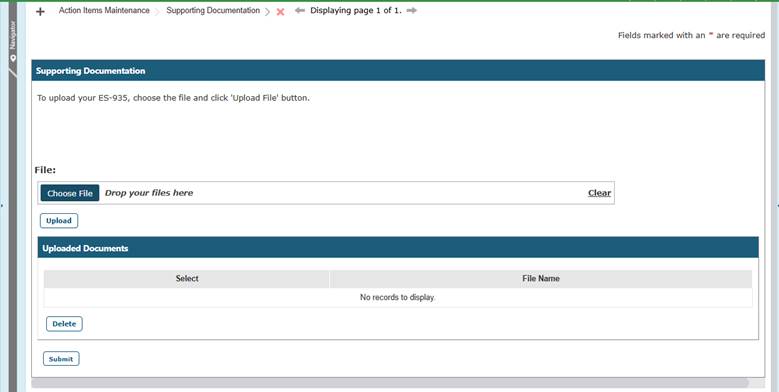

On the action item screen, click on the link “ES-935 Documentation.” This will display the next screen where the ES-935 document can be uploaded.

View Larger Image

View Larger Image

View Larger Image

View Larger Image

You may also submit the affidavit by fax to 410-333-5142 or by mail to: Division of Unemployment Insurance, Federal Claims Unit, P.O. Box 17094, Baltimore, MD 21297.

After you apply, you will receive a benefit determination, both inMaryland Unemployment Insurance Portal (BEACON) and through your preferred communication method, which you will select when you apply. This document is formally called the Statement of Wages and Monetary Determination. The determination will include whether you are eligible for unemployment insurance under the UCFE program, your weekly benefit amount, and more. A determination typically takes at least 3-4 weeks.

Once your federal wages are confirmed with your employer, you may receive a second benefit determination with an updated weekly benefit amount.

If it is determined that you are ineligible, you may file an appeal throughMaryland Unemployment Insurance Portal (BEACON) (the online system) or in writing (by mail, e-mail, or fax). Instructions on how to submit an appeal are included on your benefit determination.

To submit an appeal in writing, send it to:

Mail: Maryland Department of Labor

Lower Appeals Division

2800 W. Patapsco Avenue

Baltimore, MD 21230

Fax: 410-225-9781

E-mail: UILowerAppeals.Labor@maryland.gov

To file an appeal inMaryland Unemployment Insurance Portal (BEACON):

- Log in toMaryland Unemployment Insurance Portal (BEACON) and select "Correspondence" from the left menu. Then, select the search button.

- If you have a determination that you may appeal, there will be a “File Appeal” link on the end of the row of that Determination.

- Select the “File Appeal” link and follow the prompts to file an appeal. At the end of that process, you will receive an appeal number.

Your former employer may also appeal a determination that awards benefits to you. See the UI Appeals webpage and the File an Appeal tutorial video.

If you qualify for unemployment insurance benefits, your weekly benefit amount will range from $50 (minimum) to $430 (maximum). The amount is calculated based on your earnings during the base period (either standard or alternate).

- For the standard base period, we go back 18 months and look at the wages you earned in the first year of the 18-month period.

- An alternate base period claim can only be filed when there are not enough wages earned in the standard base period to file a valid claim, and you meet all other UI eligibility criteria. The alternate base period is the one-year period (four most recently-completed calendar quarters) prior to the date you applied for UI benefits.

NOTE: Unemployment insurance benefits are subject to federal income tax. You may choose to have taxes withheld from your benefits (when you file an initial claim) or pay the taxes when due. You can also update your withholding status inMaryland Unemployment Insurance Portal (BEACON). To do so, log in, navigate to the Quick Actions section of the homepage, select the Change Tax Withholding link, and follow the prompts.

A 1099-G tax form is issued to anyone who received UI benefits in the previous calendar year. If you received UI benefits in Maryland, your 1099-G will show the total amount of Maryland UI benefit payments that were issued to you during that year.

Notify us of any additional payments you receive. A questionnaire will be sent to you regarding these payments, and we will determine if they affect the start date of your benefits.

After you apply for unemployment insurance under the UCFE program in Maryland, you must meet Maryland’s eligibility requirements to receive benefit payments each week. These requirements, which are the same for the UCFE program and regular UI, include:

- being able to work and available for work (without undue restrictions) and meeting work search requirements;

- on-time filing of weekly claim certifications (your request to be paid UI benefits for a given week of unemployment);

- accepting suitable work, when offered;

- reporting all payments you received or that you know you will receive. This includes wages (from permanent, temporary, or part-time work, self-employment income, tips, commission payments, etc.), your first payment from a pension you did not previously report, etc., on your weekly claim certification.

- You do not need to report Social Security income.

- NOTE: If you receive certain payments (severance, vacation, holiday, bonus, back pay or damages, or other special payments) after filing an initial claim, report those payments by calling a claims agent at 667-207-6520.

- being available and contacting the Maryland Division of Unemployment Insurance and/or the Maryland Division of Workforce Development and Adult Learning (DWDAL) when instructed to do so.

- You may be selected for a mandatory reemployment workshop, such as the Reemployment Services and Eligibility Assessment (RESEA) workshop. This workshop is intended to support workers in understanding the resources that are available to support you in your reemployment efforts.

See the Eligibility Requirements FAQs to learn more.

An eligibility issue may result in your benefits being delayed or denied. You can see if there is an issue on your claim inMaryland Unemployment Insurance Portal (BEACON) by logging in and selecting “Eligibility Issues'' from the left menu. You may also contact a claims agent through our our main number 667-207-6520 and select option #9 (Monday to Friday, 8:00 a.m. to 4:00 p.m.).

- Call a Claims Agent: Speak with an agent by calling our 667-207-6520 and selecting option #9 (Monday to Friday, 8:00 a.m. to 4:00 p.m.).

- Technical support: If you are experiencing technical difficulties, such as an alert saying your request can’t be processed, please contact Customer Service at 667-207-6500 and indicate that you are calling for technical support. You may also send an email to MDUI.TechSupport@maryland.gov.

- UI Resources: For more information, see How to Apply for and Collect Benefits.

- Job-Seeker Services: Services for job seekers are offered online and at locations statewide. Services include job training, career counseling, veteran services, youth workforce programs, apprenticeship programs, adult education, and more.

- The Professional Outplacement Assistance Center (POAC) provides free job search assistance to Marylanders who are in the professional, executive, technical, managerial, or scientific occupations. For information or to request assistance, please contact dlwdalpoac-labor@maryland.gov.

- DWDAL also oversees Maryland’s American Job Centers, which offer employment and training resources at 33 locations throughout Maryland.

- Assistance from the Maryland Department of Human Services: If you are receiving UI benefits, you may be eligible for additional benefits and services, such as supplemental food assistance and energy assistance.

Your former employer (federal agency) must verify your employment, wages, and reason for separation. If they don’t respond within 12 days, the state can have you fill out an ES-935, a claimant affidavit of Federal Civilian Service, Wages, and Reason for Separation, to move your claim along. A lack of response from an agency will not hold the Maryland Division of Unemployment Insurance from determining your eligibility.

Unemployment compensation for federal employees works differently than regular UI for private sector employees. Private employers report wages each quarter for all employees into state databases that are accessed when their laid off workers apply. For federal employees who are laid off, states must request data from the applicable federal agency. This request is made by mail to the point of contact indicated on your SF8. If the federal agency has not yet responded to report your wages, your determination may initially appear as $0. This number will be updated based on the wage information received.

The process for UCFE is less automated than regular UI, which can make it take longer. For example, MD Labor must request wage information from federal agencies and receive it for each individual worker, rather than accessing it through a shared database. To receive an update on the status of your claim, you can log in throughMaryland Unemployment Insurance Portal (BEACON) at any time or you can call 667-207-6520, Monday to Friday, 8 a.m. to 4 p.m., and dial option #9.

Unemployment benefits are only payable for weeks that you have certified that you are unemployed and looking for work. Certification should be done each week, including while you are waiting for benefits.

In Maryland, you can certify online at Claimant Page and clicking: “File Weekly Certification” or calling 667-207-6520.